SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. [ ])

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the Appropriate Box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 240.14a-12 |

VUZIX CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

| ¨ |

(1) Amount Previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed

VUZIX CORPORATION

25 Hendrix Road,

West Henrietta, New York 14586

(585) 359-5900

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 22, 202015, 2023

Dear Stockholder:

You are cordially invited to attend the annual meetingAnnual Meeting (the “Annual Meeting” or the “Meeting”) of stockholders of Vuzix Corporation. The meetingMeeting will be held on June 15, 2023, at 10:30 a.m. (eastern time) both at Vuzix corporate offices located at 25 Hendrix Road, West Henrietta, New York, 14586 and as a virtual online meeting, and will take place on June 22, 2020 at 10:30 a.m. (local time), for the following purposes:

| 1. | To elect |

| 2. | To ratify the selection of Freed Maxick CPAs, P.C. as the independent registered public accounting firm of the Company for the year ending December 31, |

| 3. | To conduct an advisory vote on executive compensation. |

| 4. | To approve the Vuzix Corporation 2023 Equity Incentive Plan. |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The record date for the annual meeting is May 7, 2020.April 17, 2023. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof. Our transfer books will not be closed.

| By Order of the Board of Directors | |

| /s/ | |

| Corporate Secretary |

| Dated: | May 1, 2023 |

| West Henrietta, New York |

You are cordially invited to attend in person or virtually attend the meeting on June 22, 202015, 2023, by telephone, mobile device or Internet. We are furnishing proxy materials to some of our shareholders via the Internet by mailing a Notice of Internet Availability of Proxy Materials, instead ofrather than mailing or emailing copies of those materials. The Notice of Internet Availability of Proxy Materials directs shareholders to a website where they can access our proxy materials, including our proxy statement and our annual report, and view instructions on how to vote via the Internet, mobile device, or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.

| 1 |

Table of Contents

| 2 |

VUZIX CORPORATION

25 Hendrix Road

West Henrietta, New York 14586

(585) 359-5900

FOR 20202023 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished to shareholders in connection with the solicitation of proxies by the Board of Directors of Vuzix Corporation (“Vuzix”, the “Company”, “we”, “our”, or “us”) in connection with the annual meetingAnnual Meeting of shareholders of the Company to be held on June 22, 202015, 2023 at 10:30 a.m., local time,Eastern Time, both in person at Vuzix corporate offices located at 25 Hendrix Road, West Henrietta, New York, 14586 and virtually via the Internet (the "Annual Meeting"“Annual Meeting” or the “Meeting”).A copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2019,2022, filed with the Securities and Exchange Commission ("SEC") is available without charge upon written request to the Company's Secretary at the Company's corporate offices, or from the SEC's website at www.sec.gov.

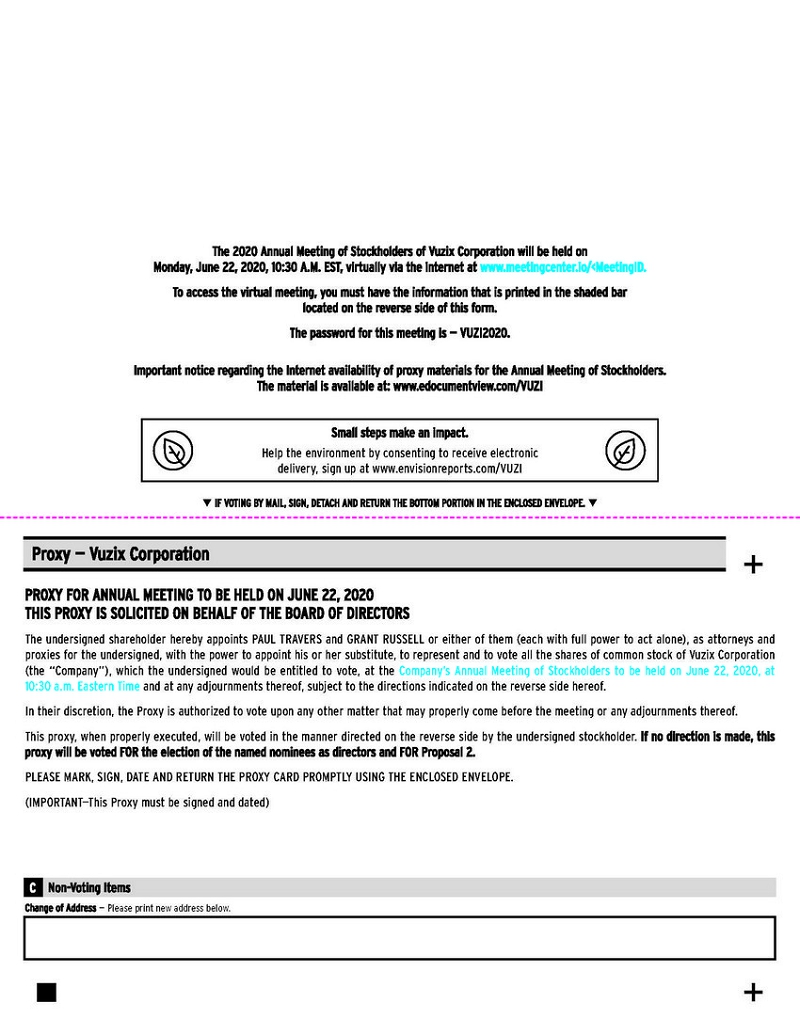

The Annual Meeting will be held both as an in-person meeting at our corporate offices and as a completely virtual meeting of stockholders which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting in person and virtually online. As an online andattendee, you may submit your questions during the meetingMeeting by visiting www.meetingcenter.io/<MeetingID.www.virtualshareholdermeeting.com/VUZI2023. You also will be able to vote your shares online by attending the Annual Meeting virtually by webcast.webcast by visiting www.virtualshareholdermeeting.com/VUZI2023.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. The password for the meeting is VUZI2020.Please note you will need your 16-digit control number included on your proxy card.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The in person and online meeting will begin promptly at 10:30 a.m., Eastern Daylight Time. We encourage you to attend or access the meeting prior to the start time leaving ample time for the check-in. Please follow the registration instructions as outlined in this proxy statement.

SOLICITATION AND REVOCABILITY OF PROXIES

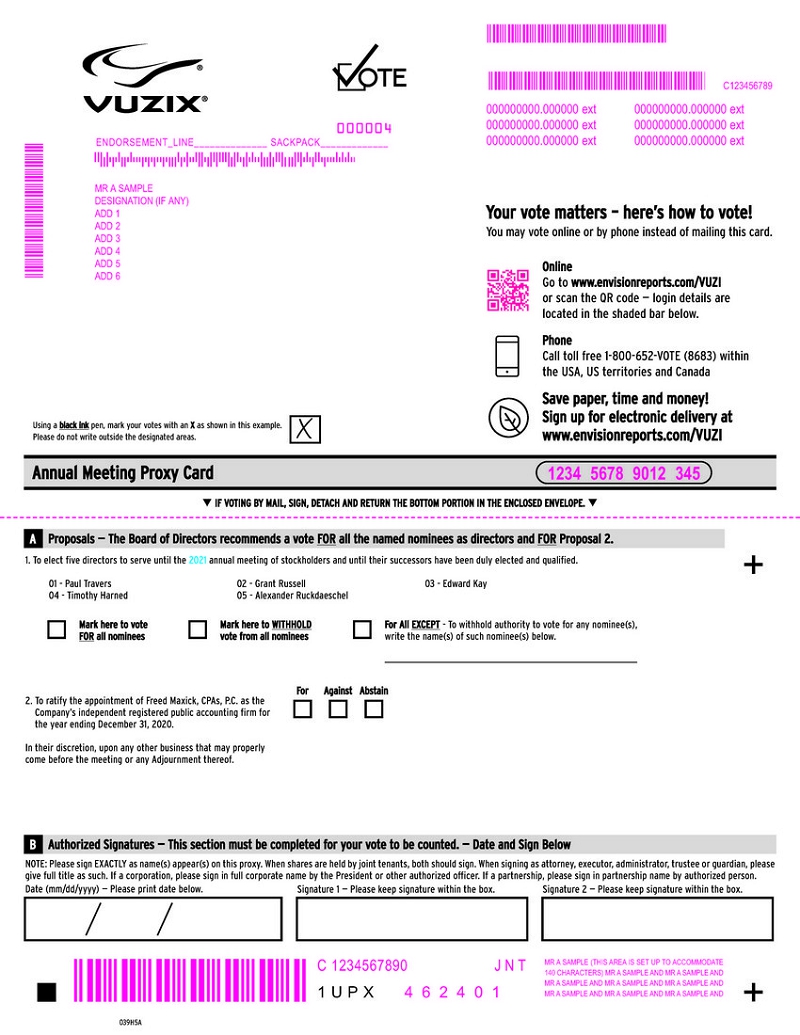

The enclosed proxy for the Annual Meeting is being solicited by the Board of Directors of the Company. Shareholders of record may vote by mail, telephone, or via the Internet. The toll-free telephone number and Internet web site are listed on the enclosed proxy. If you vote by telephone or via the Internet you do not need to return your proxy card. If you choose to vote by mail, please mark, date and sign the proxy card, and then return it in the enclosed envelope (no postage is necessary if mailed within the United States). Any person giving a proxy may revoke it at any time prior to the exercise thereof by filing with the Secretary of the Company a written revocation or duly executed proxy bearing a later date. The proxy may also be revoked by a shareholder attending the Meeting, withdrawing the proxy and voting in person virtually by attending the meetingMeeting online and voting by webcast.

The expense of preparing, printing and mailing the form of proxy and the material used in the solicitation thereof will be borne by the Company. In addition to solicitation by mail, proxies may be solicited by the directors, officers and regular employees of the Company (who will receive no additional compensation therefor)therefore) by means of personal interview, e-mail, telephone or facsimile. It is anticipated that banks, brokerage houses and other institutions, custodians, nominees, fiduciaries or other record holders will be requested to forward the soliciting material to persons for whom they hold shares and to seek authority for the execution of proxies; in such cases, the Company will reimburse such holders for their charges and expenses.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The close of business on May 7, 2020April 17, 2023, has been fixed as the record date for determination of the shareholders entitled to notice of, and to vote at, the Annual Meeting. On that date, we anticipate there will bewere outstanding and entitled to vote 33,100,00063,208,186 shares of common stock, each of which is entitled to one vote on each matter at the Annual Meeting, and 49,626 shares of Series A Preferred stock, convertible into 4,962,600 shares of common stock. Shares of the Series A Preferred Stock are entitled to vote on an as-converted basis with the common stock, such that each share of Series A Preferred Stock is entitled to 100 votes on each matter at the Annual Meeting.

Pursuant to the Company's bylaws and applicable provisions of the Delaware General Corporation Law, the vote of: (i) holders of a pluralitymajority of the shares of common stock and Series A Preferred Stock (on an as-converted basis) presentfor which votes are cast with respect to each director nominee (not including abstentions), in person, (virtually invirtually (in this case of virtually, by attending the meetingMeeting online and voting by webcast) or by properly executed proxy, and entitled to vote will be required to elect members to the Board of Directors, and (ii) the affirmative vote of a majority of shares of common stock and Series A Preferred Stock (on an as-converted basis) cast on this proposal (including abstentions) will be required to ratify the appointment of the independent auditors.auditors, and (iii) the affirmative vote of a majority of shares of common stock cast on this proposal (including abstentions) will be required to ratify the approval of the Vuzix Corporation 2023 Equity Incentive Plan. The advisory vote on executive compensation will not be binding on either the Board of Directors or the Company. However, the Board of Directors and the Company’s Compensation and Human Capital Committee will take into account the outcome of the stockholder votes on this proposal when considering future executive compensation arrangements, as applicable. See “How many votes are needed to approve each Proposal?”

The presence, in person, (virtually invirtually (in this case of virtually, by attending the meetingMeeting online and voting by webcast) or by properly executed proxy, of the holders of shares of common stock and Series A Preferred Stock (on an as-converted basis) entitled to cast one-third of all the votes entitled to be cast at the Annual Meeting is necessary to constitute a quorum. Holders of shares of common stock and Series A Preferred Stock represented by a properly signed, dated and returned proxy will be treated as present at the Annual Meeting for purposes of determining a quorum. Proxies relating to "street name" shares that are voted by brokers will be counted as shares present for purposes of determining the presence of a quorum, but will not be treated as votes cast at the Annual Meeting as to any proposal as to which the brokers do not have voting instructions and discretion. These missing votes are known as “broker non-votes.”

| 3 |

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We are sending you this proxy statement and the enclosed proxy card because the Board of Directors of Vuzix Corporation is soliciting your proxy to vote at the 20202023 Annual Meeting of Stockholders. We invite you to attend the Annual Meeting and request that you vote on the proposals described in this proxy statement. The Annual Meeting will be held both in person and virtually on Monday,Thursday, June 22, 202015, 2023, at 10:30 a.m. Eastern Daylight Time. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, date, sign and return the enclosed proxy card by mail, or follow the instructions on the proxy card to vote by telephone or via the Internet.

We are providing this notice proxy statement and the accompanying proxy card on or about May 13, 20205, 2023, to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on May 7, 2020,April 17, 2023, the record date for the meeting,Meeting, will be entitled to vote at the annual meeting.Annual Meeting. On April 29, 2020,May 1, 2023, the filing date of this proxy statement, there were 33,100,00063,208,186 shares of common stock (each entitled to one vote) outstanding and 49,626 shares of Series A Preferred Stock (each entitled to 100 votes) outstanding.

Stockholder of Record: Shares Registered in Your Name

If on May 7, 2020,April 17, 2023, your shares of Vuzix Corporation common stock were registered directly in your name with our transfer agent, Computershare Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meetingMeeting or virtually by attending the meetingMeeting online and voting by webcast or vote by proxy. Whether or not you plan to attend in person or virtually attend during the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on May 7, 2020,April 17, 2023, your shares of Vuzix Corporation common stock were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting virtually. However, since you are not the stockholder of record, you may not vote your shares in person at the meetingMeeting or virtually unless you request and obtain a signed letter or other valid proxy from your broker or other agent.

What am I voting on?

There are twofour matters scheduled for a vote: (i) the election of five (5)seven (7) directors to serve until the 20212024 Annual Meeting of stockholders, and (ii) the ratification of the selection of Freed Maxick CPAs, P.C. as our independent registered public accounting firm for the year ending December 31, 2020.2023, (iii) the advisory vote on executive compensation, and (iv) the ratification of the Vuzix Corporation 2023 Equity Incentive Plan. Our Board of Directors does not intend to bring any other matters before the meetingMeeting and is not aware of anyone else who will submit any other matters for which a vote will be required. However, if any other matters properly come before the Annual Meeting, the people named on the proxy card, or their substitutes, will be authorized to vote on those matters in their own judgment.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock or 100 votes for each share of Series A preferred stock you owned as of May 7, 2020.April 17, 2023.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least one-third of the outstanding shares of common stock and Series A Preferred Stock (on an as-converted basis) entitled to vote are present at the meeting. Your shares are counted as present at the meeting if:

| · | You are present and vote in person at the meeting or virtually by attending online and voting by webcast; |

| · | You have properly submitted a proxy card; or |

| · | You have voted via the Internet or by telephone. |

| 4 |

Your shares will be counted towards the quorum only if you submit a valid proxy card, have voted via the Internet, have voted via telephone, or vote in person at the meeting virtually by attending online and voting by webcast. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How do I vote?

The procedures for voting are set forth below:

Stockholder of Record: Shares Registered in Your Name

| · | If you are a stockholder of record, you will be able to vote your shares in person or online by attending the Annual Meeting virtually and voting by webcast. |

| · | Whether or not you plan to attend the |

| · | To vote via the Internet or by telephone, follow the instructions on the enclosed proxy card. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you hold your shares through an intermediary, suchare held in street name and you desire to vote in person or online during the Virtual Annual Meeting, you should follow the instructions provided by your bank, broker or other holder of record to be able to participate in the meeting.

Stockholders as a bank or broker, you must register in advance toof the close of business on the Record Date may attend the Annual Meeting virtuallyin person or online, vote your shares electronically and submit your questions during the Meeting, by following the instructions on the Internet.

To registerMeeting website, www.virtualshareholdermeeting.com/VUZI2023. You will need to attend the Annual Meeting online and vote by webcast, you must submit proofhave your 16-Digit Control Number included on your notice of internet availability or your proxy power (legal proxy) reflecting your Vuzix Corporation holdings along with your name and email addresscard (if you received a printed copy of the proxy materials) to Computershare. Requests for registration mustjoin the Meeting virtually. Online access to the Meeting, which will be labeled as “Legal Proxy” and be received no later than 5:00 p.m.an audio-only webcast, will begin at 10:30 a.m., Eastern Daylight Time, on June 16, 2020.

You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

By email:

Forward the email from your broker, or attach an image of your legal proxy, to:

legalproxy@computershare.com

By mail:

ComputershareVuzix Corporation Legal ProxyP.O. Box 43001Providence, RI 02940-3001

15, 2023.

How are votes counted?

You may either vote “FOR” or “WITHHOLD” authority to vote“FOR,” “AGAINST,” OR “ABSTAIN” for each nominee for the Board of Directors. You may vote “FOR”, “AGAINST” or “ABSTAIN” on the proposal to ratify the selection of Freed Maxick CPAs, P.C. as the independent registered public accounting firm of the Company for the year ending December 31, 2020.2023. You may vote “FOR”, “AGAINST” or “ABSTAIN” on the proposal to approve the Vuzix Corporation 2023 Equity Incentive Plan. You may vote “FOR”, “AGAINST” or “ABSTAIN” on the advisory vote on executive compensation.

If you submit your proxy, vote via the Internet or by telephone but abstain from voting or withhold authority to vote on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of determining a quorum. Your shares also will be counted as present at the Annual Meeting for the purpose of calculating the vote on ratification of the particular matter with respect to whichselection of the Company’s accounting firm if you abstained from voting or withheld authority to vote.

If you abstain from votingvote on a proposal,that matter, meaning your abstention has the same effect as a vote against that proposal, except, however, an abstentionproposal. Abstention has no effect on the election of members to the Board of Directors.See “How many votes are needed to approve each Proposal?”

If you hold your shares in street name and do not provide voting instructions to your brokerage firm, the brokerage firm may still be able to vote your shares with respect to certain “discretionary” (or routine) items, but it will not be allowed to vote your shares with respect to certain “non-discretionary” items. In the case of non-discretionary items, for which no instructions are received, the shares will be treated as “broker non-votes”. Shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum but will not be considered entitled to vote on the proposal in question. Your broker does not have discretionary authority to vote on the election of members to the Board of Directors, on the advisory vote on executive compensation, or on approval of the Vuzix Corporation 2023 Equity Incentive Plan, but will have discretionary authority to vote on the proposalproposals relating to the ratification of the selection of the accounting firm. As a result, if you do not vote your street name shares, your broker has the authority to vote on your behalf with respect to Proposal 2 (the ratification of the selection of the accounting firm). We encourage you to provide instructions to your broker to vote your shares for the nominees to the Board of Directors.Directors, on the advisory vote on executive compensation, and on approval of the Vuzix Corporation 2023 Equity Incentive Plan.

How many votes are needed to approve each Proposal?

| · | Proposal 1 -Election of Directors |

DirectorsDirector nominees in uncontested director elections (when the number of director nominees does not exceed the number of board seats) are elected by the affirmative vote of the holders of a pluralitymajority of the votes represented by the shares of common stock and Series A Preferred Stock (on an as-converted basis) presentcast for this proposal (excluding abstentions) in person or virtually at the Annual Meeting in person virtually bymeeting (by attending online and voting by webcastwebcast) or by proxy. This means the number of votes cast “For” a director nominee must exceed the number of votes cast “Against” that the five (5) director nominees with the most affirmative votes will be elected. Withheld votes, abstentionsnominee. Abstentions and broker non-votes will have no effect.

| · | Proposal 2 –Ratification of the selection of Freed Maxick CPAs, P.C. as the independent registered public accounting firm of the Company for the year ending December 31, |

To be approved, the ratification of the selection of Freed Maxick CPAs, P.C. as our independent auditors for our 20202023 fiscal year, must receive “For” votes from the holders of a majority of shares of common stock and Series A Preferred Stock (on an as-converted basis) cast for this proposal.proposal, including abstentions. Broker non-votes will have no effect.

| · | Proposal 3 –Advisory vote on executive compensation. |

The advisory vote on executive compensation (Proposal 3) will not be binding on either the Board of Directors or the Company. However, the Company’s Compensation and Human Capital Committee will take into account the outcome of the stockholder vote on this proposal at the Annual Meeting when considering future executive compensation arrangements. To the extent there is a significant negative vote, we would communicate directly with shareholders to better understand the concerns that influenced the vote. The Board and the Compensation and Human Capital Committee would consider constructive feedback obtained through this process in making future decisions about executive compensation programs. However, your non-binding advisory votes described in Proposal 3 will not be construed (1) as overruling any decision by the Board of Directors, any Board committee or the Company relating to the compensation of the named executive officers or (2) as creating or changing any fiduciary duties or other duties on the part of the Board of Directors, any Board committee or the Company.

| · | Proposal 4 –Approval of the Vuzix Corporation 2023 Equity Incentive Plan. |

To be approved, the ratification of the Vuzix Corporation 2023 Equity Incentive Plan, must receive “For” votes from the holders of a majority of shares of common stock cast for this proposal, including abstentions. Broker non-votes will have no effect.

With respect to any other matter that properly comes before the meeting,Meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

Can I change my vote after submitting my proxy, voting via the Internet or by telephone?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any one of three ways:

| · | You may submit another properly completed proxy card with a later date. |

| · | You may send a written notice that you are revoking your proxy to our Corporate Secretary, Vuzix Corporation, 25 Hendrix Road, West Henrietta, New York, 14586. |

| · | You may attend the Annual Meeting in person or virtually and vote online by webcast. Simply attending the Annual Meeting virtually will not, by itself, revoke your proxy. |

If you hold your shares in street name, contact your broker or other nominee regarding how to revoke your proxy and change your vote.

| 6 |

How can I find out the results of the voting at the annual meeting?Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be disclosed in our report on Form 8-K that we will file with the Securities and Exchange Commission (the “SEC”) within four (4) business days after the Annual Meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, date, sign and return each proxy card, vote your shares via the Internet or by telephone for each proxy card you received to ensure that all of your shares are voted.

Who is paying for this proxy solicitation?

Vuzix Corporation will pay for the entire cost of soliciting proxies. In addition to the proxy materials being provided, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers and employees any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

When are stockholder proposals due for next year’s annual meeting?

At our annual meeting each year, our Board of Directors submits to stockholders its nominees for election as Directors.Directors and its selection of independent auditors for the current fiscal year. In addition, the Board of Directors may submit other matters to the stockholders for action at the Annual Meeting.

Our stockholders also may submit proposals for inclusion in the proxy material. These proposals must meet the stockholder eligibility and other requirements of the SEC, and for these to be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing by January 11, 2021December 31, 2023, to our Corporate Secretary, Vuzix Corporation, 25 Hendrix Road, West Henrietta, New York, 14586.

In addition, our bylaws provide that a stockholder may present from the floor a proposal that is not included in the proxy statement if the stockholder delivers written notice to our Corporate Secretary not earlier than 120 days and not later than 90 days before the first anniversary of the preceding year’s annual meeting. The notice must set forth the stockholder’s name, address and number of shares of stock they hold, a description of the business to be brought before the meeting,Meeting, the reasons for conducting such business at the Annual Meeting, any material interest they have in the proposal, and such other information regarding the proposal as would be required to be included in a proxy statement. We have received no such notice for the 20202023 Annual Meeting. For the 20212024 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 25 Hendrix Road, West Henrietta, New York, 14586, between February 13, 202114, 2024 and March 15, 2021.21, 2024.

Our bylaws also provide that if a stockholder intends to nominate a candidate for election as a member of the Board of Directors, the stockholder must deliver written notice of such intent to our Corporate Secretary. The notice must be delivered not earlier than 120 days and not later than 90 days before the first anniversary of the preceding year’s annual meeting. The notice must set forth with the stockholder’s name and address and number of shares of stock they own, the name and address of the person to be nominated, a description of all arrangements or understandings between such stockholder and each nominee and any other person (naming such person) pursuant to which the nomination is to be made by such stockholder, the nominee’s business address and experience during the past five years, any other directorships held by the nominee, the nominee’s involvement in certain legal proceedings during the past ten years and such other information concerning the nominee as would be required to be included in a proxy statement soliciting proxies for the election of the nominee. In addition, the notice must include the consent of the nominee to serve as a Directordirector if elected. We have received no such properly submitted notice for the 20202023 Annual Meeting. For the 20212024 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 25 Hendrix Road, West Henrietta, New York 14586, between February 13, 202114, 2024 and March 15, 2021.21, 2024.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the amount of our common stock beneficially owned as of April 29, 202017, 2023, by (i) each person or group as those terms are used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”), believed by us to beneficially own more than 5% of our common stock, (ii) each of our executive officers and directors, and (iii) all of our directors and executive officers as a group. Except as otherwise noted, each person named in the table has sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

| Name and Addresses of Beneficial Owner(1) | Shares Beneficially Owned(2) | Percent of Outstanding Shares Beneficially Owned(3) | ||||||

| Paul Travers | 2,687,188 | (4) | 8.1 | % | ||||

| Grant Russell | 1,060,816 | (5) | 3.2 | % | ||||

| Alexander Ruckdaeschel | 139,666 | (6) | * | |||||

| Edward Kay | 100,000 | * | ||||||

| Timothy Harned | 68,000 | * | ||||||

| Intel Corporation | 4,962,600 | (7) | 13.0 | % | ||||

| Hudson Bay Capital Management LP | 2,739,727 | (8) | 7.7 | % | ||||

| CVI Investments, Inc. | 1,739,941 | (9) | 5.2 | % | ||||

| Directors and executive officers as a group (5 people) | 4,055,670 | (10) | 12.2 | % | ||||

| Name and Addresses of Beneficial Owner (1) | Shares Beneficially Owned (2) | Percent of Outstanding Shares Beneficially Owned (3) | ||||||

| Paul Travers | 3,167,658 | (4) | 5.0 | % | ||||

| Grant Russell | 1,384,496 | (5) | 2.2 | % | ||||

| Edward Kay | 177,538 | * | ||||||

| Peter Jameson | 268,225 | * | ||||||

| Timothy Harned | 144,211 | * | ||||||

| Raj Rajgopal | 43,788 | * | ||||||

| Azita Arvani | 32,523 | * | ||||||

| Emily Nagle Green | 32,523 | * | ||||||

| ARK Investment Management LLC | 6,471,315 | (6) | 10.2 | % | ||||

| BlackRock, Inc. | 4,024,678 | (7) | 6.3 | % | ||||

| State Street Corporation | 3,495,529 | (8) | 5.5 | % | ||||

| Directors and executive officers as a group (8 people) | 5,250,989 | (9) | 8.2 | % | ||||

*less than 1.0%

| (1) | The address for each person, unless otherwise noted, is c/o Vuzix Corporation, 25 Hendrix Road, West Henrietta, New York, 14586. |

| (2) | We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, under the rules, |

| (3) | The percentage of shares beneficially owned is based on |

| (4) | Includes (i) |

| (5) | Represents (i) |

Based on Schedule 13G/A filed on February 10, |

| (7) | Based on Schedule 13G filed on February 1, 2023. The address of the stockholder is BlackRock, Inc. |

| Based on Schedule 13G filed on February 7, 2023. The address of the stockholder is State Street Financial Center, One Lincoln Street, Boston, MA 02111 | |

| (9) | Beneficial ownership for Paul Travers, Grant Russell, |

ELECTION OF DIRECTORS

The number of directors is established by the Board of Directors. Our Board currently consists of five (5)seven (7) members, all five (5)seven (7) of whom have been nominated by the Board for re-election to the Board of Directors at the Annual Meeting.

Thus, at this Annual Meeting, five (5)seven (7) persons, comprising the entire membership of the Board of Directors, are to be elected. Each elected director will serve until the Company's next annual meeting of shareholders and until a successor is elected and qualified. Our five (5)seven (7) current boardBoard members, Paul Travers, Grant Russell, Alexander Ruckdaeschel,Edward Kay, Timothy Harned, Raj Rajgopal, Azita Arvani, and Edward Kay,Emily Nagle Green were elected by the stockholders at the last annual meeting.

The Company has outstanding 49,626 shares of Series A Preferred Stock, all of which are owned by Intel Corporation (the “Series A Purchaser”). The Series A Purchaser is entitled to nominate and elect two (2) directors to the Company’s Board of Directors (the “Board Election Right”), at least one of whom will be required to qualify as an “independent” director, as that term is used in applicable exchange listing rules. The Board Election Right with respect to the independent director will terminate on such date as the number of shares of Series A Preferred Stock then outstanding is less than 40% of the original amount purchased by the Series A Purchaser. The Board Election Right with respect to the second director will terminate on such date as the number of shares of Series A Preferred Stock then outstanding is less than 20% of the original amount purchased by the Series A Purchaser. The Series A Purchaser has not yet exercised the Board Election Right. The Company also granted the Series A Purchaser the right to have a board observer at meetings of the Company’s Board of Directors and committees thereof. The Series A Purchaser has not yet exercised the Board Election Right or their right to appoint an observer and, in November 2016, notified the Company that it no longer wishes to pursue a strategic relationship with the Company.

The Company anticipates that the accompanying proxy will be voted in favor of the five (5)seven (7) persons listed below to serve as directors unless the stockholder indicates to the contrary on thesuch proxy. All nominees have consented to serve if elected. We expect that each of the nominees will be available for election, but if any of them is not a candidate at the time the election occurs, it is intended that such proxynomination will be voted fordeemed revoked and the election of another nominee todirector seat will be designatedvacant until filled by the Board of Directors to fill any such vacancy.or vote of the stockholders at a meeting.

For the election of directors, only proxies and ballots, Internet votes or telephone votes, marked “FOR all nominees”, “WITHHELD for all nominees”“FOR” or specifying that votes be withheld for“AGAINST” one or more designated nominees are counted to determine the total number of votes cast; votes that are withheldcast. Abstentions are excluded entirely from the vote and will have no effect. Abstentions will have no effect on the vote for the election of directors. Directors are elected by a pluralitymajority of the votes cast. This means that the five (5) nominees who receivenumber of votes cast “for” a director nominee must exceed the most affirmativenumber of votes will be elected.cast “against” that nominee.

The term of office of each person elected as a director will continue until the next annual meeting or until his or her successor has been elected and qualified, or until the director’s death, resignation or removal.

The Board of Directors considers diversity, including gender and ethnicity, in the makeup of the Board when evaluating director candidates. Qualifications that it considers include the nature and breadth of business experience, professional certification, and education.

The following table is a matrix of director skills, qualifications and demographic backgrounds. The Nominating and Governance Committee regularly evaluates the skills, qualifications, and demographic backgrounds desirable for our Board to best advance our business strategies and serve the interests of all our stakeholders.

| 9 |

| P. Travers | G. Russell | E. Kay | T. Harned | E. Nagle Green | A. Arvani | R. Rajgopal | |

| Governance Guidelines Criteria: | |||||||

| Independent | P | P | P | P | P | ||

| Senior Leadership Experience (1) | P | P | P | P | P | P | |

| Industry Experience (2) | P | P | P | P | P | P | |

| Board Experience (3) | P | P | P | P | |||

| Financial Expertise (4) | P | P | P | ||||

| Age | 61 | 70 | 67 | 58 | 65 | 60 | 62 |

| Tenure (years) | 24 | 13 | 6 | 5 | 1 | 1 | 1 |

| Gender: | |||||||

| Female | P | P | |||||

| Male | P | P | P | P | P | ||

| Non-Binary Gender | |||||||

| Race/Ethnicity(5): | |||||||

| Black or African American | |||||||

| Hispanic or Latino | |||||||

| White | P | P | P | P | P | P | |

| Asian (including South Asian) | P | ||||||

| Native American | |||||||

| Two or More Races or Ethnicities | |||||||

| LGBTQ+ | |||||||

| Did not Disclose Race/Ethnicity | |||||||

Notes:

| 1. | Senior Leadership Experience – experience as president, CEO or in similar senior executive positions |

| 2. | Industry Experience – experience in the technology sector, including software and hardware |

| 3. | Board Experience – prior or concurrent service on other U.S. public company boards |

| 4. | Financial Expertise – expertise in accounting, auditing, tax, banking, insurance or investments |

| 5. | Race/Ethnicity – based on each director’s self-identification in our 2023 Board questionnaire |

The names of thecurrent directors and director nominees, their ages as of April 29, 2020,May 1, 2023, and certain information about them, including their business experience during the past five years and their directorships of other publicly held corporations, are set forth below.

| 10 |

Background of Current Directors and Director Nominees

| Paul Travers, age 61, is a co-founder of Vuzix and has served as our President and Chief Executive Officer since 1997 and as a member of our Board of Directors since November 1997. Prior to the formation of Vuzix, Mr. Travers founded both e-Tek Labs, Inc. and Forte Technologies Inc. He has been a driving force behind the development of our products. With more than 30 years’ experience in the consumer electronics field, and 26 years’ experience in the virtual reality and virtual display fields, he is a nationally recognized industry expert. He holds an Associate degree in engineering science from Canton, ATC and a Bachelor of Science degree in electrical and computer engineering from Clarkson University. Mr. Travers resides in Honeoye Falls, New York. Mr. Travers’ experience as our founder and Chief Executive Officer qualifies him to serve on our Board of Directors. |

Paul Travers, age 58, is the founder of Vuzix and has served as our President and Chief Executive Officer since 1997 and as a member of our Board of Directors since November 1997. Prior to the formation of Vuzix, Mr. Travers founded both e-Tek Labs, Inc. and Forte Technologies Inc. He has been a driving force behind the development of our products. With more than 30 years’ experience in the consumer electronics field, and 26 years’ experience in the virtual reality and virtual display fields, he is a nationally recognized industry expert. He holds an Associate degree in engineering science from Canton, ATC and a Bachelor of Science degree in electrical and computer engineering from Clarkson University. Mr. Travers resides in Honeoye Falls, New York. Mr. Travers’ experience as our founder and Chief Executive Officer qualifies him to serve on our Board of Directors.

| Grant Russell, age 70, is a co-founder and has served as our Chief Financial Officer and Executive Vice President since 2000 and as a member of our Board of Directors since April 2009. From 1997 to 2004, Mr. Russell developed and subsequently sold a successful software firm and a new concept computer store and cyber café. In 1984, he co-founded Advanced Gravis Computer (Gravis), which, under his leadership as President, grew to become the world’s largest PC and Macintosh joystick manufacturer with sales of $44 million worldwide and 220 employees. Gravis was listed on NASDAQ and the Toronto Stock Exchange. In September 1996 it was acquired by a US-based Fortune 100 company via a successful public tender offer. Mr. Russell holds a Bachelor of Commerce degree in finance from the University of British Columbia and is both a US Certified Public Accountant and a Canadian Chartered Professional Accountant. Mr. Russell resides in Vancouver, British Columbia, Canada and has a secondary residence in West Henrietta, New York. Mr. Russell’s business executive and financial experience qualifies him to serve on our Board of Directors. |

| Edward Kay, age 67, has been a director of the Company since April 2016. Mr. Kay is a Certified Public Accountant who spent his 33-year career with PricewaterhouseCoopers LLP (PwC) working with companies in a wide variety of industries, including manufacturing, distribution, software and technology. Mr. Kay served as PwC’s Rochester, NY Office Managing Partner for 13 years from 1999 to 2012 and, for a time, Managing Partner of the firm’s Upstate NY practice and had been the Leader of PwC’s high technology practice in Dallas, TX from 1993 to 1999. Mr. Kay was formerly a Board member, Executive Committee member, and Audit Committee Chair of IEC Electronics (NYSE: IEC) from 2013 to 2015 and is currently on the board of a large private company in the product distribution business. During Mr. Kay’s tenure at PwC and through his service on other corporate boards, he accumulated extensive experience in financial, securities, and business matters, including significant leadership roles in addressing accounting and auditing matters related to public companies, which make Mr. Kay a financial expert and qualifies him to serve on our Board of Directors. |

| Timothy Harned, age 58, is an investment banking, corporate development, and financial advisory veteran with more than 30 years of experience in mergers and acquisitions, capital markets, and related activities. Mr. Harned has been a director of the Company since June 2017. Mr. Harned is also a technology specialist with more than 20 years of experience in various technology fields, including communications, mobility, and software, and another ten years working with consumer and industrial companies. He began his career at Lehman Brothers (1987 to 1992) within the mergers and acquisitions group. Upon receiving his Masters in Business Administration in 1994, Mr. Harned went on to serve as a corporate development executive (1994 to 1996) and later joined Banc of America Securities (1996 to 2000) where he became a Managing Director. Mr. Harned subsequently joined Morgan Stanley & Co. (2000 to 2002) where he served as Executive Director focused on mergers and acquisitions and capital markets advisory for technology companies. From 2003 to 2016, Mr. Harned served in leadership positions at several technology-focused financial and strategic advisory boutiques. In 2016, Mr. Harned founded 8Nineteen Advisory, LLC where he served as Managing Partner and CEO while functioning as a strategic C-suite consultant regarding growth matters and providing financial advisory services, with a specialty in mergers and acquisitions and corporate and business development. He led 8Nineteen Advisory from December 2016 until it was acquired by Progress Partners, Inc. in May 2021. Since that time, he has served as Managing Director at Progress Partners in their Boston headquarters. Over his career, Mr. Harned has led strategic transactions for both Fortune 500 companies as well as earlier stage high growth enterprises. In addition, he has successfully completed multiple cross-border transactions for U.S. acquirers entering the markets of both established and developing countries. Mr. Harned' s capital markets, corporate development, mergers and acquisitions, and strategic and financial advisory experience in the technology and consumer fields qualifies him to serve on our Board of Directors. |

Grant Russell, age 67, has served as our Chief Financial Officer and Executive Vice President since 2000 and as a member of our Board of Directors since April 2009. From 1997 to 2004, Mr. Russell developed and subsequently sold a successful software firm and a new concept computer store and cyber café. In 1984, he co-founded Advanced Gravis Computer (Gravis), which, under his leadership as President, grew to become the world’s largest PC and Macintosh joystick manufacturer with sales of $44 million worldwide and 220 employees. Gravis was listed on NASDAQ and the Toronto Stock Exchange. In September 1996 it was acquired by a US-based Fortune 100 company via a successful public tender offer. Mr. Russell holds a Bachelor of Commerce degree in finance from the University of British Columbia and is both a US Certified Public Accountant and a Canadian Chartered Professional Accountant. Mr. Russell resides in Vancouver, British Columbia, Canada and has a secondary residence in West Henrietta, New York. Mr. Russell’s business executive and financial experience qualifies him to serve on our Board of Directors.

Alexander Ruckdaeschel, age 47, joined our Board of Directors in November 2012. Since March 2001, Mr. Ruckdaeschel has worked in the financial industry in the United States and Europe as a co-founder, partner and/or in senior management. Mr. Ruckdaeschel co-founded Herakles Capital Management and AMK Capital Advisors in 2008. Mr. Ruckdaeschel has also been a partner with Alpha Plus Advisors, from 2006 to 2010, and Nanostart AG, from 2002 to 2006, where he was the head of their US group. Mr. Ruckdaeschel has significant experience in startup operations as the manager of DAC Nanotech-Fund and Biotech-Fund from 2002 to 2006. Following service in the German military, Mr. Ruckdaeschel was a research assistant at Dunmore Management focusing on intrinsic value identifying firms that were undervalued and had global scale potential. From October 1992 to October 2000 Mr. Ruckdaeschel was in the German military and supported active operations throughout the Middle East while also participating as a professional biathlon athlete. Mr. Ruckdaeschel’s financial experience qualifies him to serve on our Board of Directors.

| 11 |

Edward Kay, age 64, has been a director of the Company since April 2016. Mr. Kay is a Certified Public Accountant who spent his 33-year career with PricewaterhouseCoopers LLP (PwC) working with companies in a wide variety of industries, including manufacturing, distribution, software and technology. Mr. Kay served as PwC’s Rochester, NY Office Managing Partner for 13 years from 1999 to 2012 and, for a time, Managing Partner of the firm’s Upstate NY practice and had been the Leader of PwC’s high technology practice in Dallas, TX from 1993 to 1999. Mr. Kay was formerly a Board member, Executive Committee member, and Audit Committee Chair of IEC Electronics (NYSE: IEC) from 2013 to 2015 and is currently on the board of a large private company in the product distribution business. During Mr. Kay’s tenure at PwC and through his service on other corporate boards, he accumulated extensive experience in financial, securities, and business matters, including significant leadership roles in dealing with accounting and auditing matters related to public companies, which make Mr. Kay a financial expert and enable him to be a valuable contributor to the Vuzix Board of Directors.

| Azita Arvani, age 60, is a customer-focused Hi-Tech leader who delivers innovation-led revenue growth. Ms. Arvani has served as a director of the Company since June 2021. With over two decades in digital industries, she brings extensive experience in leveraging disruptive technologies such as 5G, AI, IoT, cloud, and AR/VR, commercializing innovations, and building partnerships and ecosystems. She currently serves as General Manager of Rakuten Mobile Americas where she drives the development, strategy and deployment of the business in the Americas. Prior to joining Rakuten in February 2020, she worked at Nokia, most recently as Head of Innovation Partner & Venture Management. She led the company’s leading-edge global team where she discovered, partnered with, and mentored hundreds of rapid-growth innovative companies. She has deep experience in both established Fortune 500 companies and rapid-growth startups. She is an avid evangelist of true digital transformation for telecommunication companies, as well as other industries. Ms. Arvani has been on the Board of Directors of the Tennant Company (NYSE: TNC) since October 2012 with a focus on innovation and serves on the Compensation and Governance Committees. Her experience in technology markets and innovation and especially in AR/VR use cases is particularly valuable as Vuzix evolves its business to the next level and accelerates its market expansion. For these reasons, Ms. Arvani is qualified to serve on our Board of Directors. |

Timothy Harned, age 55, is an investment banking, corporate development, and financial advisory veteran with more than 30 years of experience in mergers and acquisitions and related activities. Mr. Harned is also a technology specialist with more than twenty years of experience in various technology fields and another ten years working with consumer and industrial companies. Mr. Harned is currently the Founder and Managing Partner of 8Nineteen Advisory, LLC where he serves as a strategic consultant regarding growth matters and provides financial advisory services, with a specialty in mergers and acquisitions and corporate and business development. He has been with 8Nineteen Advisory, LLC since December 2016. He began his career at Lehman Brothers (1987 to 1992) within the mergers and acquisitions group and later joined Banc of America Securities (1996 to 2000) where he became a Managing Director. Mr. Harned subsequently joined Morgan Stanley & Co. (2000 to 2002), where he served as an Executive Director focused on merger and acquisition and capital markets advisory for technology companies. Mr. Harned also spent more than a decade (2003 to 2016) with several technology-focused financial advisory boutiques and has also served as a corporate development executive (1994 to 1996). Mr. Harned’s corporate development and strategic and financial advisory experience in the technology and consumer fields qualifies him to serve on our Board of Directors.

| Emily Nagle Green,age 65, is a long-time executive in the technology sector, with over 30 years of experience in introducing and scaling a wide variety of advanced technologies. Ms. Green has served as a director of the Company since June 2021. Following completion of a M.S. Engineering in computer graphics and artificial intelligence, she began her professional career developing special-effects software for supercomputers; later she led marketing for a fiber-optic communications technology firm. She served for (eight) 8 years with Forrester Research, a leading technology advisory firm, where she predicted consumer technology adoption, advised executives, and later built the firm’s European operations. She was the CEO and later Chairman of Yankee Group Research, and the launching CEO of Smart Lunches, a fast-growing eCommerce startup. She is an accomplished author and currently serves on the boards of Casella Waste Systems (NASD: CWST) and Centerspace Residential (NYSE: CSR), chairing the Nominating & Governance committees for both companies. Since 2015, she has professionally coached over 30 CEOs in the tech sector on strategy, leadership, and board management. In the non-profit sector she leads the Boston Chapter of All Raise, the national organization that supports women founders and funders. She is a member of NACD and Women Corporate Directors. We believe Ms. Green’s success in scaling advanced technologies, her experience as a CEO, and the breadth of her public board experience particularly in governance qualify her to serve on our Board of Directors. |

| Raj Rajgopal, age 62, is a seasoned industry executive with over 30 years of experience working with large enterprises implementing digital strategies and driving transformational growth. Mr. Rajgopal has served as a director of the Company since June 2021. He is currently the President of RR Advisory Services, LLC, an advisory firm he founded in 2019 that offers due diligence and consulting services to venture capital and private equity investors. Prior to that, he served in various leadership roles at Virtusa Corporation, including President, where he successfully led the company’s growth from under $50 million to a leading digital solutions provider with revenues of more than $1 billion. During his tenure as President at Virtusa, he supported the company’s 28 consecutive quarters of growth and led due diligence efforts on a number of successful acquisitions. Prior to Virtusa, he held multiple leadership roles in both the U.S. and the U.K. at Capgemini, a global leader in consulting, technology services and digital transformation. At Capgemini, he helped technology and telecommunication clients build differentiated strategies to scale their business. He was also a Director of Advanced Technologies at BGS Systems, Inc. He has an undergraduate degree in Mechanical Engineering and advanced degrees in Computer Science, Industrial Engineering and Business. Mr. Rajgopal currently serves as a member of the Board of Directors at CTG Corporation (Nasdaq: CTG) and as a former Board Observer at Wevo Conversion. His deep knowledge of enterprise markets, expertise in digital transformation, experience rapidly scaling a small enterprise and his relevant degrees in engineering and business, qualify him to serve on our Board of Directors. |

RECOMMENDATION OF THE BOARD FOR PROPOSAL 1

Our Board of Directors unanimously recommend A VOTE FOR THE ELECTION

AS DIRECTORS OF THE NOMINEES LISTED ABOVE

Information Regarding the Board and its Committees

Director Meeting and Attendance

During 2019,2022, our Board of Directors held one (1) in-person and four (4) in-personconference call regular meetings, ten (10)two (2) additional conference-call meetings and acted one (1) timeeight (8) times by unanimous written consent. In addition, the directors considered Company matters and had frequent communication with each other apart from the formal meetings. No boardBoard member attended fewer than 75% of the total boardBoard meetings or of meetings held by all committees on which hesuch member served during 2019.2022.

Our Board of Directors currently consists of Messrs. Travers, Russell, Ruckdaeschel, Kay, and Harned. Biographical information regarding Messrs. Travers, Russell, Ruckdaeschel, Kay, and Harned is set forth above.

Board Independence

Our Board of Directors has determined that each of our current directors and director nominees, (who are also our current directors) other than Mr. Travers and Mr. Russell, is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and NASDAQ rules. We believe that we are compliant with the independence criteria for boards of directors under applicable laws and regulations and the NASDAQ Stock Market. The boardBoard has met and may continue to meet independently of management as required.

| 12 |

Board Committees

We have an audit committee,Audit Committee, a compensation committeeCompensation and Human Capital Committee, a nominating committee.Nominating and Governance Committee and an Acquisition Committee.

Audit Committee

Our audit committeeAudit Committee consists of Edward Kay, Timothy Harned, and Alexander Ruckdaeschel,Emily Nagle Green, each of whom is a non-employee director. Our Board of Directors has determined that each member of our audit committeeAudit Committee is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and meets the requirements of financial literacy under SEC rules and regulations and the NASDAQ Stock Market. Mr. Kay is the chairperson of our audit committeeAudit Committee and is considered an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and meets the requirements of financial literacy under SEC rules and regulations and the NASDAQ Stock Market. Mr. Kay serves as our audit committeeAudit Committee financial expert, as defined under SEC rules. Our audit committeeAudit Committee met five (5)six (6) times during 2019.2022.

Our audit committeeAudit Committee is responsible for, among other things:

| · | selecting and hiring our independent auditors, and approving the audit and non-audit services to be performed by our independent auditors; |

| · | evaluating the qualifications, performance and independence of our independent auditors; |

| · | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| · | reviewing the adequacy and effectiveness of our internal control policies and procedures; |

| · | reviewing the adequacy and effectiveness of our cybersecurity, information and technology security, and data privacy programs, procedures, and policies; |

| · | discussing the scope and results of the audit with the independent auditors and reviewing with management and the independent auditors our interim and year-end operating results; and |

| · | preparing the |

Our Board of Directors has adopted a written charter for our audit committee,Audit Committee, which is available on the investor relations section of our website (www.vuzix.com).

Compensation and Human Capital Committee

Our compensation committeeCompensation and Human Capital Committee consists of Alexander Ruckdaeschel,Emily Nagle Green, Edward Kay and Timothy Harned, each of whom is a non-employee director. Mr. RuckdaeschelMs. Green is the chairperson of our compensation committee.Compensation and Human Capital Committee. Our Board of Directors has determined that each member of our compensation committeeCompensation and Human Capital Committee is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and under the current rules of the NASDAQ Stock Market. Our compensation committeeCompensation and Human Capital Committee met four (4)seven (7) times in 2019.2022. Although the committee has expanded its role over the past few years, this year, the committee updated its name and charter to encapsulate more of the human capital responsibilities around workforce engagement, diversity, equity, inclusion (DEI), and talent management.

Our compensation committeeCompensation and Human Capital Committee is responsible for, among other things:

| · | reviewing and approving compensation of our executive officers including annual base salary, annual incentive bonuses, specific goals, equity compensation, employment agreements, severance and change-in-control arrangements, and any other benefits, compensation or arrangements; |

| · | reviewing and recommending compensation goals, bonus, and stock compensation criteria for our employees; | |

| · | working with Senior Management on executive professional development and succession planning; |

| · | reviewing and working with management on strategies and policies related to Vuzix’ human capital management function, DEI, and talent management; | |

| · | preparing any |

| · | administering, reviewing and making recommendations with respect to our equity compensation plans. |

Our Board of Directors has adopted a written charter for our compensation committee,Compensation and Human Capital Committee, which is available on the investor relations section of our website (www.vuzix.com).

Compensation and Human Capital Committee Interlocks and Insider Participation

During the year ended December 31, 2019,2022, no member of our compensation committeeCompensation and Human Capital Committee was one of our officers or employees. Moreover, none of our executive officers served as a member of the Board of Directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our Board of Directors or compensation committeeCompensation and Human Capital Committee during 2019.2022.

Involvement in Certain Legal Proceedings

| 13 |

None of our directors or executive officers has been involved in any legal proceeding in the past 10 years that would require disclosure under Item 401(f) of Regulation S-K.

Nominating and Governance Committee

Our nominating committeeNominating and Governance Committee consists of Alexander Ruckdaeschel, Timothy Harned, Azita Arvani and Edward Kay,Raj Rajgopal, each of whom is a non-employee member of our Board of Directors. Mr. Harned wasis the chairperson of our nominating committee.Nominating and Governance Committee. Our Board of Directors has determined that each member of our nominating committeeNominating and Governance Committee is an independent director as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and under the rules of the NASDAQ Stock Market. Our nominating committeeNominating and Governance Committee met three (3) times in 2019.2022. This year the committee updated its name and charter to encapsulate more of the Environmental, Social and Governance aspects of the business.

Our nominating committeeNominating and Governance Committee is responsible for, among other things:

| · | presenting a list of individuals recommended for nomination for election to the Board of Directors at the annual meeting of shareholders; |

| · | reviewing the composition of each committee and present recommendations for committee |

| · | establishing and reviewing on an annual basis the Nominating and Governance Committee’s policy with regard to the consideration of any director candidates recommended by the Company’s shareholders, including the procedures to be followed by the Company’s shareholders in submitting such recommendations; |

| · | evaluating and |

| · | developing and recommending to the Board of Directors a set of corporate governance guidelines applicable to the Company; and |

| · | reviewing DEI and Environmental, Social and Corporate Governance (ESG) policies, specifically evaluating the Company's corporate responsibilities around sustainability initiatives and its role as a socially responsible and diverse organization |

Our Board of Directors has adopted a written charter for our nominating committee,Nominating and Governance Committee, which is available on the investor relations section of our website (www.vuzix.com).

Nominating Process

The process followed by the nominating committeeNominating and Governance Committee to identify and evaluate candidates includes requests to boardBoard members, the chief executive officer, and others for recommendations, meetingsmeeting from time to time to evaluate any biographical information and background material relating to potential candidates and their qualifications, and interviews of selected candidates. Nominations of persons for election to our Board of Directors may be made at a meeting of stockholders only (i) by or at the direction of the board;Board; or (ii) by any stockholder who has complied with the notice procedures set forth in our bylaws and in the section entitled “Questions and Answers About This Proxy Material and Voting – When are stockholder proposals due for next year’s annual meeting?” In addition, stockholders who wish to recommend a prospective nominee for the nominating committee’sNominating and Governance Committee’s consideration should submit the candidate’s name and qualifications to our Corporate Secretary, 25 Hendrix Road, West Henrietta, New York 14586.

In evaluating the suitability of candidates to serve on the Board of Directors, including stockholder nominees, the nominating committeeNominating and Governance Committee seeks candidates who are independent as defined by Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act and the rules of the NASDAQ Stock Market, and who meet certain selection criteria established by the committee. The committee also considers an individual’s skills, character and professional ethics, judgment, leadership experience, business experience and acumen, familiarity with relevant industry issues, and other relevant criteria that may contribute to our success. This evaluation is performed in light of the skill set and other characteristics that would most complement those of the current directors, including the diversity, maturity, skills and experience of the Board of Directors as a whole. The boardBoard seeks the best director candidates based on the skills and characteristics required without regard to race, color, national origin, religion, disability, marital status, age, sexual orientation, gender identity and expression, or any other basis protected by federal, state or local law.

Acquisition Committee

Our Acquisition Committee consists of Timothy Harned, Edward Kay and Raj Rajgopal, each of whom is a non-employee member of our Board of Directors. Mr. Harned is the chairperson of our Acquisition Committee. Our Board of Directors has determined that each member of our Acquisition Committee is an independent director as defined under the rules of the NASDAQ Stock Market. Our Acquisition Committee met seven (7) times in 2022.

Our Acquisition Committee is responsible for, among other things:

| · | reviewing acquisition, divestiture and investment strategies and performance with the Company’s management, including how such activities align with and advance the Company’s overall growth strategy and objectives; |

| · | investigating and overseeing the due diligence of transaction candidates on behalf of the Board, and otherwise supporting and assisting with the evaluation of proposed transactions; |

| 14 |

| · | reviewing, providing support and assistance, and recommending for authorization and approval by the Board of acquisition, divestiture and investment transactions proposed by the Company’s management in which the total consideration to be paid or received by the Company, in cash, stock or other consideration, meets certain requirements that may be established by the Board from time to time; |

| · | reviewing and recommending for approval by the Board performance objectives for acquisitions or investments as proposed by Management, and from time-to-time review actual performance of acquisitions or investments relative to pre-set objectives; |

| · | considering strategic objectives and risks associated with the Company’s acquisition, divestiture and investment activities, including assessment of the strategy, business model, financial performance, capital needs and projections submitted by transaction candidates; |

| · | at least annually, reviewing and assessing the adequacy of its Charter and evaluating the performance of the committee and recommending any proposed changes to the Board; and |

| · | reporting regularly to the full Board on the committee’s actions and activities. |

Our Board of Directors has adopted a written charter for our Acquisition Committee, which is available on the investor relations section of our website (www.vuzix.com).

Code of Ethics and Business Conduct

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors. The full text of our code of business conduct and ethics is posted on the investor relations section of our website (www.vuzix.com)(www.vuzix.com).

Involvement in Certain Legal Proceedings

None of our directors or executive officers has been involved in any legal proceeding in the past ten (10) years that would require disclosure under Item 401(f) of Regulation S-K.

Corporate Governance and Related Matters

Board Leadership Structure

Our Board of Directors is responsible for the selection of the chairmanChairman of the boardBoard and the chief executive officer.Chief Executive Officer. Our boardBoard does not have a policy on whether or not the roles of chief executive officerChief Executive Officer and chairmanChairman should be separate and, if they are to be separate, whether the chairman should be selected from the non-employee directors or be an employee. Currently our chief executive officerChief Executive Officer acts as chairman.Chairman. Our boardBoard believes that Paul Travers, our founder and chief executive officer,Chief Executive Officer, is best suited to act as chairmanChairman of the boardBoard because he is the director most familiar with the Company’s business and industry and is therefore best able to identify the strategic priorities to be discussed by the board.Board.

Our boardBoard believes that the most effective board structure is one that emphasizes board independence and ensures that the board’sBoard’s deliberations are not dominated by management. ThreeFive of our fiveseven current directors (who are also our five director nominees) qualify as independent directors within the meaning of Rule 10A-3 promulgated by the SEC pursuant to the Exchange Act andas defined under NASDAQ rules and regulations. Each of our standing boardBoard committees is comprised of only independent directors, including our nominating committee,Nominating and Governance Committee, which is charged with evaluating and reporting to the boardBoard on the performance and effectiveness of the board,Board, as necessary. Our board has not appointed a

In 2022, we established the role of Lead Independent Director, who is elected by the Board of Directors annually. The current lead independent director. Director is Edward Kay. The Lead Independent Director is responsible for, among other things:

| · | Presiding at all meetings of the Board of Directors at which the Chairman is not present, and at all Executive Sessions of Board meetings; |

| · | Presiding at all meetings of the independent directors; |

| · | Calling meetings of the independent directors; |

| · | Serving as the principal liaison between the Chairman and the independent directors relative to all substantive discussions. While this role is not intended to impede in any way the degree and/or frequency of any direct communications between the Chairman and other independent directors, it is expected that any substantive discussions that take place between the other independent directors and Chairman will be communicated on a timely basis by the independent director(s) to the Lead Independent Director, and vice versa; |

| 15 |

| · | Communicating, on behalf of the Independent Directors and Compensation and Human Capital Committee, the Board evaluation of the CEO’s performance; |

| · | Guiding and assessing all information sent to the Board of Directors, including the quality, quantity, appropriateness, and timeliness of such information; |

| · | Assisting the Chairman in the construct of meeting agendas; |

| · | Helping establish the frequency of Board of Directors meetings and meeting schedules, ensuring there is sufficient time for adequate discussion of all agenda items; |

| · | Recommending to the Nominating and Governance Committee and to the Chairman, selections for membership and chair for each Board Committee, though such recommendations are not necessarily binding in nature; |

| · | Interviewing, along with the chair of the Nominating and Governance Committee, all director candidates and making recommendations to the Nominating and Governance Committee; |

| · | When appropriate, being available for consultation and direct communication with stockholders; and |

| · | Having the authority to select and retain (or approve in advance the selection and retention of) outside counsel, advisors, and/or consultants who report directly to the Board of Directors on Board-wide issues. |

On an annual basis and in consultation with the independent directors, the Lead Independent shall review its charter and recommend to the Board of Directors for approval any modifications or changes.

Our Board’s Role in Risk Oversight

Our management is responsible for risk management on a day-to-day basis. The role of our boardBoard and its committees includes overseeing the risk management activities of management. Our boardBoard oversees our risk management processes directly and through its committees. The audit committeeAudit Committee assists the boardBoard in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls, cybersecurity, and compliance with legal and regulatory requirements, and discusses policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which our exposure to risk is handled. The compensation committeeCompensation and Human Capital Committee assists the boardBoard in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs.programs and talent management. The nominating committeeNominating and Governance Committee assists the boardBoard in fulfilling its oversight responsibilities with respect to the management of risks associated with boardBoard organization, membership and structure, and succession planning for our directors. The Acquisition Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with acquisitions, investments and divestitures, as the case may be.

Communications with the Board of Directors

Stockholders and other parties may communicate directly with the Board of Directors or the relevant board member by addressing communications to:

Vuzix Corporation

c/o Corporate Secretary

25 Hendrix Road,

West Henrietta, New York 14586

All stockholder correspondence will be compiled by our corporate secretary and forwarded as appropriate.

Director Attendance at Annual Meetings

We have scheduled a Board of Directors meeting in conjunction with our annual meetingAnnual Meeting of stockholdersStockholders and, while we do not have a formal policy regarding attendance at annual meetings, we as a general matter we expect that the directors will attend the annual meeting, except in the case of virtual online-only meetings. All of our directors attended our 2019 annual meeting in person.2022 Annual Meeting virtually.

| 16 |

RATIFICATION OF THE SELECTION OF THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 20202023

The audit committeeAudit Committee has selected the accounting firm of Freed Maxick CPAs, P.C. (“Freed Maxick”) to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2020.2023. Freed Maxick has served as the Company’s independent registered public accounting firm since October 2014 and is considered by the audit committee,Audit Committee, the Board of Directors, and management of the Company to be well qualified.

The stockholders are being asked to ratify the audit committee’sAudit Committee’s appointment of Freed Maxick CPAs, P.C. for the year ending December 31, 2020.2023. If the stockholders fail to ratify this appointment, the audit committeeAudit Committee may, but will not be required to, reconsider whether to retain that firm. Even ifIf the appointment is ratified, the audit committeeAudit Committee in its discretion may direct the appointment of a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders. A representative of Freed Maxick, CPAs, P.C. will be present at the annual meetingAnnual Meeting virtually and will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Fees Paid to Freed Maxick CPAs, P.C.

The following table shows the fees that were billed by Freed Maxick CPAs, P.C. to the Company for professional services rendered in 20192022 and 2018.2021.

| 2019 | 2018 | |||||||

| Audit Fees(1) | $ | 236,000 | $ | 236,269 | ||||

| Audit-Related Fees(2) | 2,000 | - | ||||||

| Tax Fees(3) | 20,800 | 12,500 | ||||||

| All Other Fees | - | - | ||||||

| Total Freed Maxick CPAs, P.C. Fees | $ | 258,800 | $ | 248,769 | ||||

| 2022 | 2021 | |||||||

| Audit Fees (1) | $ | 379,090 | $ | 326,821 | ||||

| Audit-Related Fees (2) | - | 46,250 | ||||||

| Tax Fees (3) | 29,950 | 67,243 | ||||||

| All Other Fees(4) | 15,500 | 8,800 | ||||||

| Total Freed Maxick CPAs, P.C. Fees | $ | 424,540 | $ | 449,114 | ||||

(1) Audit fees primarily represent amounts billed for the audit of our annual consolidated financial statements for such respective fiscal year and quarterly reviews of our consolidated financial statements.